|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

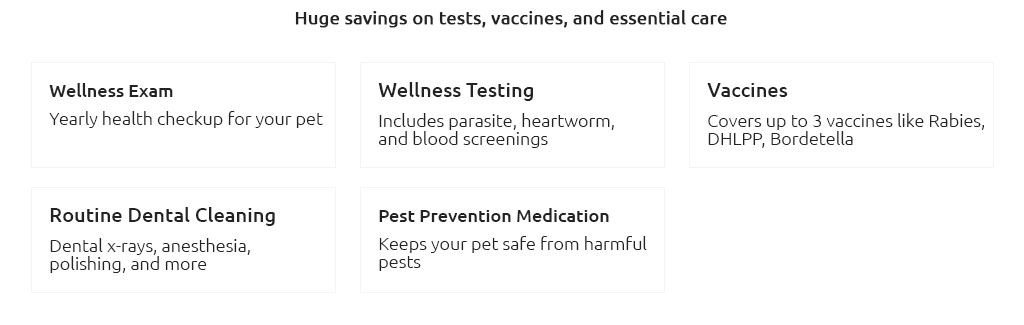

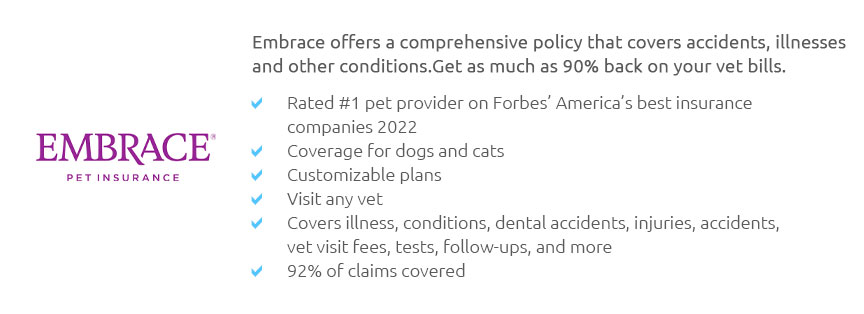

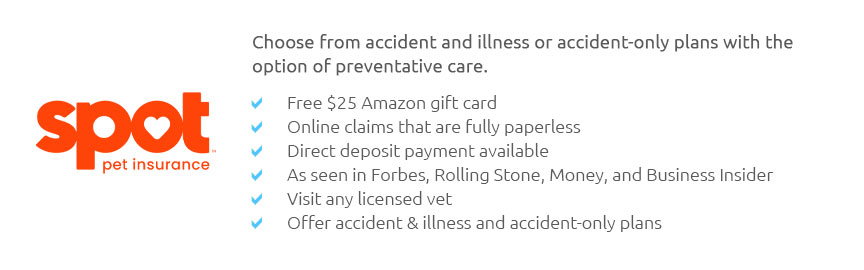

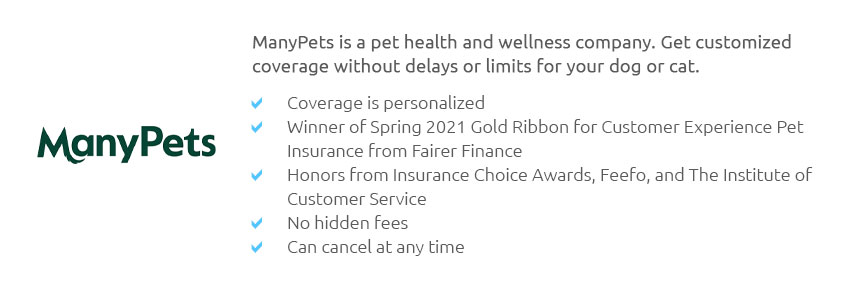

medical insurance for pets policy essentials for stability and comparisonWhy I'm revisiting this policyI've renewed twice and adjusted coverage once, chasing steadier costs without losing key protections. The first year felt theoretical; the second became real when a Sunday emergency visit for my dog's blocked intestine turned into a $3,800 bill. After the deductible, the plan reimbursed most of it within a week. That moment validated the choice - but also exposed what matters long-term: stability and clear comparisons. Policy basics, quicklyMost plans cover accidents and illnesses, sometimes hereditary and chronic conditions. They exclude pre-existing issues, impose waiting periods, and may treat bilateral problems (like knees) as one condition. You can usually see any licensed vet. Add-ons (wellness, dental illness, rehab) vary by insurer and state. What coverage really means in practice

Costs and the mathPremiums rise with pet age, claims trends, and regional costs. A higher deductible often slows increases and keeps monthlies stable. Example: a $7,000 knee surgery with a $500 deductible and 80% reimbursement leaves you paying $500 plus 20% of $6,500 - budgetable, not painless. Stability means anticipating rate drift and setting a deductible that you can cover from savings. Small snapshotMy switch from a $200 to $500 deductible cut the premium enough to offset a typical year of minor claims. For me, fewer small reimbursements were worth steadier long-run pricing. Claims and turnaroundModern apps make filing simple; direct pay to the vet exists but isn't guaranteed. Routine processing can run 2 - 10 days; audits take longer. Keep itemized invoices and medical notes. Pre-approvals help for expensive procedures, but emergencies rarely wait - pay first, submit later. Stability signals to check

Pros and cons from lived use

Comparison checklist (apples-to-apples)

Edge cases and pragmatic caveatsEnrollment age caps exist; once enrolled, renewal is typical but rates can rise. Switching later may reset waiting periods and turn prior issues into exclusions. Preventive add-ons are convenient but not always cost-effective. Expect prior records requests after large claims; set aside time to respond. Who benefits - and who might passHigh-variance risk (young active dogs, breeds prone to costly conditions) gains the most stability. Owners with robust emergency funds and low-risk pets may prefer self-insuring, accepting volatility. How I choose now

Bottom lineA medical insurance for pets policy won't remove uncertainty, but the right structure turns chaos into manageable, predictable risk. Compare carefully, optimize for stability, and accept the small-print caveats - then let the policy do its quiet job in the background.

|